Forex trading, the world’s largest financial market, has seen explosive growth in recent years, with trillions of dollars traded daily. Yet, its high volatility and complexity make it intimidating for most. For those looking to successfully navigate the Forex market, mastering effective strategies is essential. Here, we’ll explore key approaches that can lead to more informed and profitable Forex Trading.

Understand Market Trends

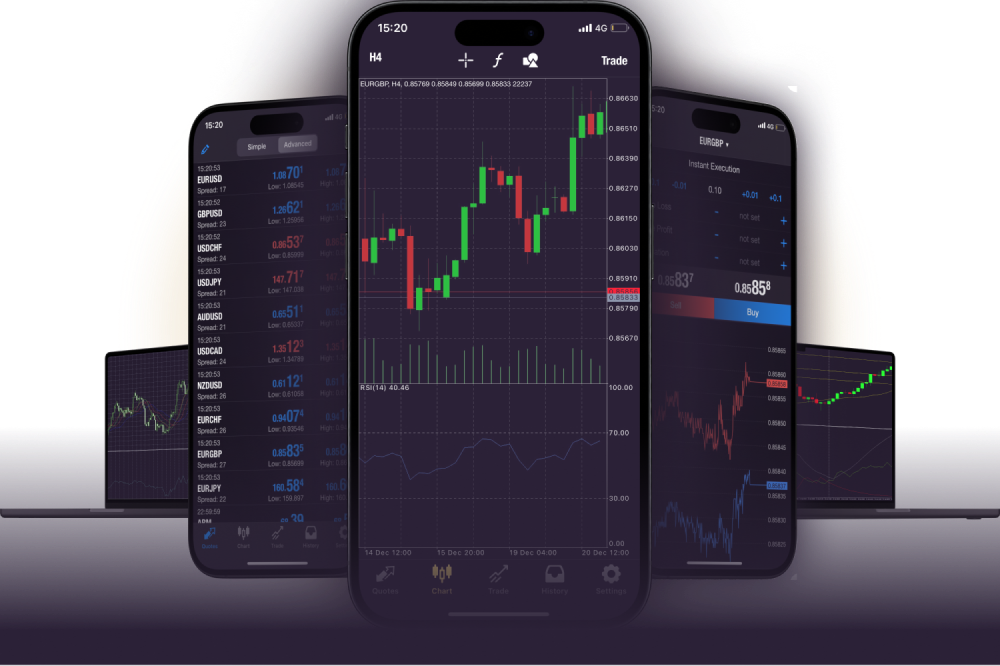

Market trends play a pivotal role in Forex trading. Successful traders often study historical data, charts, and economic indicators to identify trends. Technical analysis tools, such as moving averages or trend lines, can highlight patterns and points of support or resistance. Once a trend is established, traders can align their strategies, either buying on an upward trend or selling on a downward trend.

One statistical advantage lies in trend-following strategies. Studies have shown that trends can persist over time due to the cumulative activity of large institutional players. Capitalizing on such trends often requires patience and proper market entry timing.

Risk Management is Critical

A lack of solid risk management often results in significant losses for Forex traders. Statistics indicate that over 70% of retail traders lose money due to poor risk control. To counteract these odds, successful traders determine risk tolerance levels early and implement stop-loss orders.

Leverage, a popular tool in Forex trading, can amplify both gains and losses. While high leverage may seem appealing, statistics demonstrate that excessive leverage usage correlates strongly with account wipeouts. Limiting leveraged positions and risking only a small percentage of your capital per trade ensures that unforeseen market volatility doesn’t devastate your portfolio.

Stay Updated with Global News

Unlike traditional markets, Forex operates 24/5 and is heavily influenced by global economic and geopolitical events. Announcements related to interest rates, employment figures, or inflation can swing currency prices drastically in seconds.

Statistics reveal that informed traders who monitor economic calendars and adjust positions based on significant events often outperform those who ignore such data. Tools like economic event trackers or Forex signal services can help traders stay ahead of market changes.